Introduction: Unraveling the Enigma of Inflation

Dear readers let’s dig into the enigmatic realm of inflation – a perplexing maze where the value of money dances to an invisible tune, leaving us all in a state of economic wonder. Beyond the jargon of economists lies a captivating tale of rising prices, and in this exploration, we shall unravel the secrets of inflation, understanding the players, discerning winners and losers, and equipping ourselves with strategies to navigate this economic labyrinth.

Inflation explained easy

This mysterious force has the ability to turn our everyday financial transactions into a wild rollercoaster ride.

Inflation, in its simplest form, is the rise in the prices of goods and services over time. Imagine entering a magical marketplace where prices seem to dance to an invisible tune, leaving your hard-earned money feeling less mighty than it used to be.

The Inflation Players: Gainers and Losers

Like any good story, the world of inflation has its own set of characters – the ‘Gainers’ and the ‘Losers.’

The Gainers:

- Debtors: Step right up, debtors! In the inflation carnival, owing money becomes a little less daunting. As the value of money decreases, the cupcakes you borrowed from the Cupcake Bank become easier to repay.

The Losers:

- Savers: Have you been diligently stashing away your sweet savings? Alas, inflation is the sneaky bandit that tiptoes into your candy jar, diminishing its value. The interest rates on savings might struggle to keep up with the pace of rising prices.

- Fixed-Income Earners: Pensioners and those relying on fixed incomes, hold onto your hats! As prices pirouette upwards, the fixed amounts you receive start feeling less like a royal banquet and more like a humble picnic.

Strategies to Outsmart the Inflation Imp

Now, how do we outsmart this mischievous inflation imp and keep our wallets from feeling deflated? Fear not, for there are strategies aplenty:

- Invest Wisely: Venture into investments with the potential to outpace inflation – stocks, bonds, and real estate could be your trusty companions on this financial adventure.

- Diversify, Diversify, Diversify: Spread your financial assets like a buffet, my friends. If one dish disappoints, you still have a smorgasbord of options to satisfy your financial cravings.

- Embrace the Power of Negotiation: When prices start doing the inflation cha-cha, become a master negotiator. Bargain with vendors, hunt for discounts, and keep your eyes peeled for sweet deals.

Explaining Inflation to a Small Kid: The Candy Analogy

In the enchanted realm of financial education, explaining inflation to a small child is like casting a spell. Imagine you have a bag of candies. Now, if everyone suddenly wants more candies, the candy store might increase the prices. So, even though you have the same amount of candies, you can buy fewer toys with them. That’s a bit like inflation – prices go up, and your money doesn’t go as far as it used to.

Let’s take this analogy a step further. You’ve got your bag of candies, and you’re excited to trade them for your favorite toys. But, as if by magic, the store decides to raise the prices of those toys. Suddenly, that handful of candies that used to buy you a shiny new toy can only get you a small trinket. It’s a bit like having your pocket money, but the prices of all your favorite treats and toys decide to have a party and go up together. That’s inflation, turning your magical candy world into a bit of a puzzle.

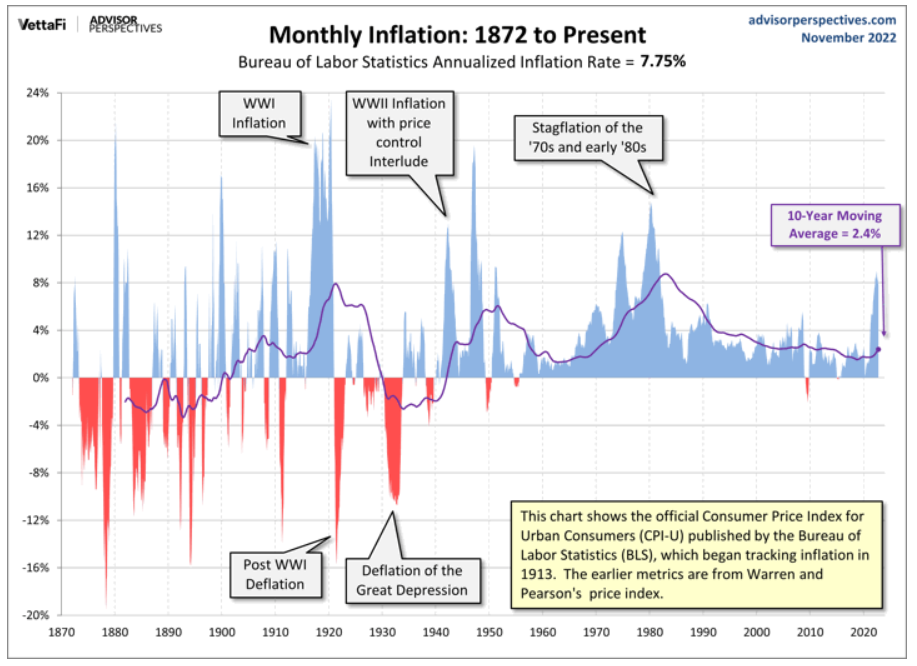

The Inflation Time Capsule

Dive into the history books, dear readers, and discover the times when inflation played a pivotal role. Travel back to ancient civilizations and explore how inflation shaped economies, influenced trade, and even played a role in historical events. Learn from the lessons of the past as we uncover the stories of societies grappling with this economic enigma.

Whether it’s the Roman Empire dealing with debased currency or the hyperinflationary woes of post-World War I Germany, the inflation time capsule reveals the impact of rising prices on the everyday lives of people. It’s a journey through time that not only educates but also serves as a cautionary tale, reminding us that while inflation is a constant in the economic landscape, its consequences can vary dramatically.

When Inflation Goes Rogue

Every now and then, inflation throws a party that gets a little too wild. In this chapter, we’ll explore the consequences when inflation goes rogue. From the infamous hyperinflation of the Weimar Republic to the more recent examples of Zimbabwe and Venezuela, we’ll examine the extreme scenarios where inflation spiraled out of control, turning currencies into confetti and leaving citizens grappling with economic chaos.

These cautionary tales underscore the importance of keeping inflation in check and highlight the delicate dance that central banks and policymakers must perform to prevent economic instability. As we unravel the stories of nations whose currencies became as valuable as monopoly money, we gain a deeper understanding of the importance of managing inflation with a steady hand.

When the Inflation Party Winds Down

Like all parties, the inflation fiesta can’t last forever. In this chapter, we’ll shine a spotlight on the mechanisms that bring the inflation party to a close. Central banks and economic wizards step in with their bag of tricks when inflation threatens to go out of control. They might raise interest rates, cool down the economy, and bring prices back to a more reasonable dance floor.

As we navigate this phase, we’ll explore the delicate balance between keeping inflation in check and ensuring that the economy doesn’t grind to a halt. It’s a dance of economic policies and monetary tools, and understanding the rhythm can provide insights into the cyclical nature of inflation and the measures taken to maintain stability.

Inflation: The Final Curtain Call

As we draw the curtains on our expedition through the labyrinth of inflation, let us remember that while prices rise, pockets may feel lighter, and economic surprises abound, financial wisdom will guide us through the twists and turns. May your investments be fruitful, your savings sweet, and your understanding of inflation as clear as a bag of candy on a sunny day!